Investing in Cryptocurrency is Risky

Cryptocurrency, or “crypto,” is a digital currency that works through a computer network that is not reliant on any government or central bank to maintain it (i.e., the US dollar is maintained by the US Treasury and Federal Reserve). Many cryptocurrencies are based on blockchain technology and are referred to as a “coin.” A blockchain is essentially a digital ledger that records ownership, each entry is called a “block.” Each block is then linked to the previous block forming a “chain” of ledgers. These blocks cannot be modified, altered, deleted, or destroyed. This makes counterfeiting cryptocurrency nearly impossible.

Over the last few years, cryptocurrency has increased in popularity, with multiple professional athletes and the mayor of New York City opting to receive their paychecks in cryptocurrency. There are some features of cryptocurrency that have made it attractive. First, it is easy to transfer funds between two parties without the need for a bank as an intermediary, making transfers faster than traditional bank transfers. Second, the value of a crypto coin can generate a rate of return if the value increases. Lastly, since cryptocurrency is not regulated by the government, it has become a popular method for criminal activity, including money laundering, child pornography, and ransomware hackers.

The two most popular cryptocurrencies are Bitcoin and Ethereum, but there are over 10,000 different cryptocurrencies in existence (as of February 2022).

Stock Value vs Crypto Value

Determining the Value of a Stock

Investors use fundamental analysis to determine the intrinsic value of a stock. This allows investors to determine if the stock price overvalues or undervalues a company. To analyze the fundamentals of a stock, investors use ratio analysis to determine if a company is strong and growing at its core operations. Investors also use a Dividend Discount Model, a Residual Income Model, and/or a Discounted Cash Flow Model to estimate the value of a company/stock. The intrinsic value of a company comes from its operations. A company that is generating revenue from selling a desirable product, effectively managing its assets and debts, and not losing cash, generally has value and is a good investment. If a company continues to do these things well and can expand, then the value of that company will grow. If it cannot, then it will decline. Companies that have good fundamentals are generally a sound investment and are more likely to have long-term growth in the stock market.

An important note: good investors never invest based on just the stock price; they use the analytical tools mentioned above to determine if a stock has strong fundamentals before investing.

Determining the Value of a Cryptocurrency

Unlike a stock, cryptocurrencies are not tied to the performance of a company, but rather the belief that they will be more popular in the future than they are today. Cryptocurrency is what is called a speculative asset. When people buy and sell speculative assets, they are doing so not because they determined that the asset has intrinsic value, but because they think it will grow in popularity in the future. Speculative assets typically have large price fluctuations. There is a chance of a large increase in value, but also a risk of a large decrease in value (high-risk, high-reward).

Other examples of speculative assets are gold, silver, oil, gas, undeveloped land, and high-end art. These assets only have value if people in the future want to buy them (If you buy gold today, and tomorrow everyone decides they don’t want gold, then gold has no value). Because of the high-risk, high-reward nature of speculative assets, they often have bubbles. A bubble is where there is a large increase in the value of the asset followed by a large decrease (or crash). Figure 1 shows there have been several large bubbles of gold since 1915 and there were several gold crashes in the 1800s, which is what led to the creation of the Federal Reserve System and establishing the dollar in 1913.

While cryptocurrency has not been around that long, it does appear to have similar emerging patterns as gold with several large increases and decreases since 2015 (see Figure 2).

Over the last year (5/12/2021-5/12/2022), Bitcoin has decreased in value 43% and Ethereum has decreased 51%. Why? We cannot say because we cannot calculate the intrinsic value of Bitcoin or Ethereum, the change in price is solely based on the speculation as to how popular it will be in the future.

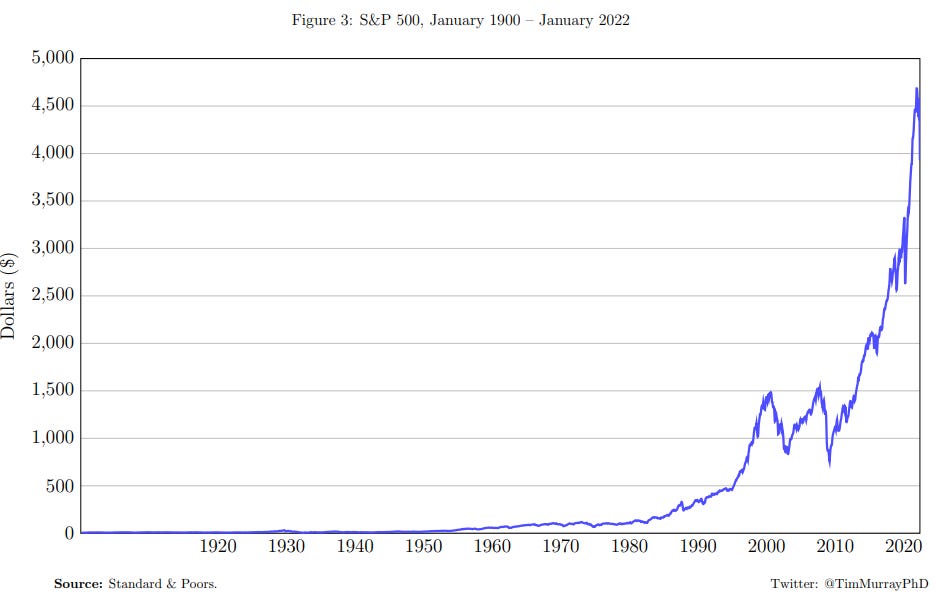

Compare gold, Bitcoin, and Ethereum to the S&P 500 shown in Figure 3. While the stock market does decrease when there is a recession, it always recovers afterwards and there is a much more stable increase over time. Why? Because the companies in the stock market have intrinsic value. During a recession, investors are concerned about companies’ ability to perform, but in the long-term, the stock market always recovers and increases because companies have intrinsic value. The same cannot be said for speculative assets, like gold and cryptocurrency, who have large changes in price with no intrinsic value.

Why is Cryptocurrency Risky?

Cryptocurrency is risky because it is a speculative asset that has no intrinsic value. The only reason cryptocurrency increases in price is because people speculate that more people will want it in the future, but the second that changes, then it will lose all its value.

If you would not invest your money in gold, silver, undeveloped land, or high-end art, then you should not invest your money in cryptocurrency. There is a possibility of earning a lot of money quickly, but you can also lose a lot of money quickly, and unlike the stock market, there is no guarantee it will go back up.

It is exceedingly difficult to do better than the average returns of the stock market. 73% of managed investment funds underperform the S&P 500 over a 5-year period, 83% underperform over a 10-year period, and 86% underperform over 20-years. If an investor beats the S&P 500 in a given year, it is pure luck, and no investor consistently beats the S&P 500 (if they tell you they do, they are lying).

Investing money always comes with some risk, but a solid investment strategy is to invest money in an S&P 500 index fund or ETF. Let that money sit in the index fund and reap the benefits of compound interest in an investment that historically, always increases, as shown in Figure 3.

People often seek get-rich-quick schemes, but they don’t exist. People that get rich off an investment just get lucky. Most people that invest in speculative assets, like cryptocurrency, or engage in options trading, lose money. Don’t be one of those people and lose your hard-earned money.

Tim Murray, PhD is an Assistant Professor of Economics at Virginia Military Institute who teaches courses on Labor Economics, Housing Economics, Corporate Finance, and Quantitative Tools for Economics and Business. More information on his teaching and scholarly research can be found at timmurrayecon.com .