The media has a great influence on how we perceive things. In the last year, we have heard many negative stories about inflation, prices, and the economy. This has led to 47% of Americans thinking the economy is poor, and 76% thinking the economy is getting worse, even though they personally think they are doing better. However, despite what you may hear, I am the bearer of good news. We are three years out from the COVID-19 pandemic and there have been many positive changes in the economy over the last year. Inflation and gas prices have significantly declined, GDP continues to grow, the unemployment rate is at historic lows, companies continue to seek and hire workers, and wages are increasing. Let us dive into some of the data to see these these changes.

Inflation

The inflation rate has been declining for a year. In May, the inflation rate was 4.1% compared to its peak last June at 8.9%. Economists like to use the core inflation rate, which excludes food and energy prices, as they tend to be more volatile from month to month. Core inflation has been trending downward over the last year, but not at the rate of inflation. Many of the previous factors that were driving inflation (see my previous post) have begun to subside. However, the cost of “shelter” has been increasing. The CPI defines “shelter” as the amount of money paid each month for rent and “owner equivalent rent,” or the amount of money homeowners could receive if they chose to rent out their house. The cost of shelter is an important component of the CPI and has risen substantially since the pandemic. The good news is that the inflation rate for shelter has declined for two consecutive months. If this trend continues, we should see core inflation drop as well. If you subtract the cost of shelter from core inflation, the inflation rate in May was 3.4%. There are many reasons to continue to be optimistic that the worst of inflation is behind us and that it will continue to decline over the next year.

We notice inflation the most when the price of gasoline increases. The good news is that the average price of gasoline in May is down 30% from its peak last June. Adjusting for inflation, the current price of gasoline is lower than it was from 2010-2014 and is not far removed from the average from 2015-2019. I have discussed previously what happened with gas prices, and there are still many uncertainties that will affect gas prices, but for now, gas prices have stabilized and, with the right international circumstances, I hope they will continue to decline.

Jobs

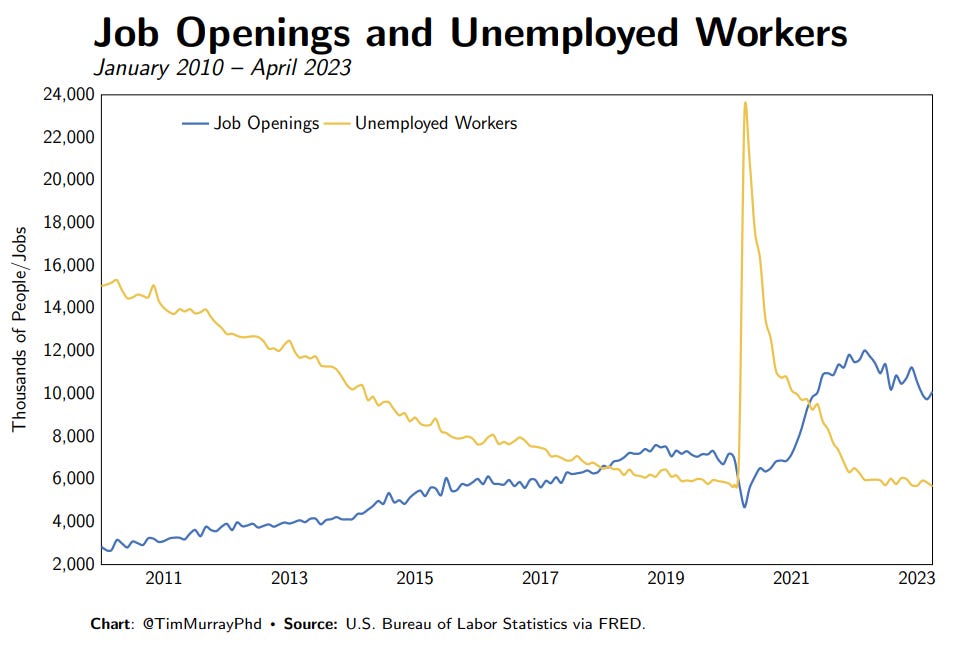

The labor market remains very strong. Companies continue to hire workers, and the number of job openings remains very high compared to before the pandemic and is well above the number of unemployed workers. In April, there were 1.8 job postings per unemployed worker. This is much higher than anything we saw in the decade before the pandemic.

The unemployment rate has remained near historic lows for the past year. In May, it was 3.7%. Furthermore, the Labor Force Participation Rate has continued to increase. Although it has not returned to its pre-pandemic levels, it is headed in the right direction.

As a result of the strong labor market and the decline in inflation, the average hourly wage rate adjusted for inflation has increased for the past year after decreasing for the previous two years and is higher than it was before the pandemic.

The labor market has been particularly strong for Black workers. The labor force participation rate for Black workers is higher than it was in the decade before the pandemic, and the Black Unemployment Rate is the lowest ever recorded.

Overall Economic Health

Even with high inflation, the US economy has continued to grow and has had positive economic growth for the last three years. The COVID-19 pandemic was a very difficult time for the economy, with so many people losing their jobs and so many businesses closing. The pandemic was followed by international supply chain and manufacturing issues. However, we are now several years removed from this, and there continue to be no signs that the US economy is headed toward a recession. Things could change in the coming months, especially with student loan payments resuming later this year, but do not let the negativity of news headlines or politicians fool you, for the last year, the US economy has been and continues to be strong.