What is going on with Inflation?

Over the 18 months, we have all seen news headlines and politicians talk about inflation. Often, these conversations are pointing the finger at who is to blame and are devoid of a deep discussion of root causes.

First, it is important to understand what inflation is. The inflation rate is the “average” rate of increase of prices from one month to the next or one year to the next. This does not mean that all prices increase. Some go up, some go down, and some stay the same. Economists often look at core inflation, which measures prices that exclude food and energy. These prices can often be volatile in the short run. If these prices are truly increasing, then they will cause the prices of other products to increase. If the inflation rate is positive, that means the “average” price level is increasing. If the inflation rate is negative, that means the “average” price level is decreasing. Typically, prices increase every year and inflation is a byproduct of a growing economy. When prices decrease, that is called deflation and typically is a byproduct of an economic recession or downturn.

In this post, I will discuss inflation, first focusing on the drivers of core inflation and then discuss food and energy.

Core Inflation

When inflation is often discussed in the news, it is how the price level has changed from one year ago. However, inflation is reported each month and it can sometimes be more informative to look at the annualized month-by-month inflation rate (i.e., what would the annual inflation rate be if the change in prices from last month to this month were to hold over the course of the year) because sometimes things can change throughout the course of the year which will influence year-by-year inflation (e.g., the base effect).

The Federal Reserve has 2% target for the core inflation rate. Prior to the pandemic, the core inflation rate fluctuated around this target. At the beginning of the pandemic, the average price level decreased at a 4% annualized monthly rate which has been followed up increases in the average price level.

There are two different types of inflation:

Demand-Pull Inflation is when people want to buy more of a product than companies can produce, thus driving up prices

Cost-Push Inflation is when the costs of production (e.g., raw materials and wages) increases and drives up prices

During the pandemic, companies worldwide decreased the quantity of products they were producing because of a decrease in demand and lack of workers due to the pandemic. As people started getting vaccinated and fueled by pandemic relief checks, many increased their economic activity (e.g., going out to eat). As a result, the United States economy is currently experiencing both demand-pull inflation and cost-push inflation due to a shortage of products and high demand.

Income Growth and the Economy

Disposable income is the amount of money people have left to spend after they pay taxes. Because of multiple stimulus checks, increased unemployment benefits, and increases in hourly wages, people have more money to spend. As more people have become vaccinated and pandemic restrictions have been lifted, some people have been spending this extra income, which has increased economic activity. This increased economic activity is causing demand-pull inflation, but it is a sign of a growing economy.

However, the products we (and everyone else in the world) buy are produced in a multitude of countries. There is an international supply chain of imports and exports that allows these products to be dispersed around the world. The pandemic caused many disruptions to this supply chain as factories temporarily shut down. For months, the volume of production around the world drastically decreased and the existing inventories were consumed. While many factories are back up and running, there is an international labor shortage meaning they may not be operating at full capacity (see one of my previous posts for an explanation of the labor shortage). The disruption to the supply-chain has likely led to some cost-push inflation.

We can look at how the price levels have changed for specific categories to get an understanding of what drives inflation and whether these factors are likely to be long-term issues or short-term transitory issues.

Durable Goods

The price of durable goods has been declining for around 30 years and the annualized month-over-month inflation rate has fluctuated around zero. However, the inflation rate for durable goods has drastically increased over the last 18 months, which is largely driven by the prices of new and used cars. There is a shortage of new cars due to manufacturing issues in other countries, particularly with the production of computer chips. This is likely a temporary issue as the production of these chips has been affected by the pandemic. Unless there is a major change to how people buy durable goods and how they are produced as the pandemic draws to an end, there is no reason that the inflation rate should not stabilize as the supply-chain issues sort themselves out. How long this will take is uncertain as there is no way to predict how each country is going to handle new variants and waves of COVID-19, but eventually the inflation rate for durable goods should return to pre-pandemic levels.

Non-Durable Goods

The month-over-month inflation rate for non-durable goods when excluding food and apparel can be noisy compared to other categories. There was a huge decline in the prices of non-durable goods at the beginning of the pandemic and there has been some increase in the inflation rate during the pandemic, but nothing that is extreme relative to the types of pattens observed prior to the pandemic.

Services

Prices for services have been increasing for around 30 years and has had an average annualized month-over-month inflation rate of that fluctuates around 3%. Since the pandemic, there has been more volatility in the month-over-month inflation rate, the inflation rate for services is much more stable relative to pre-pandemic levels when compared to durable goods.

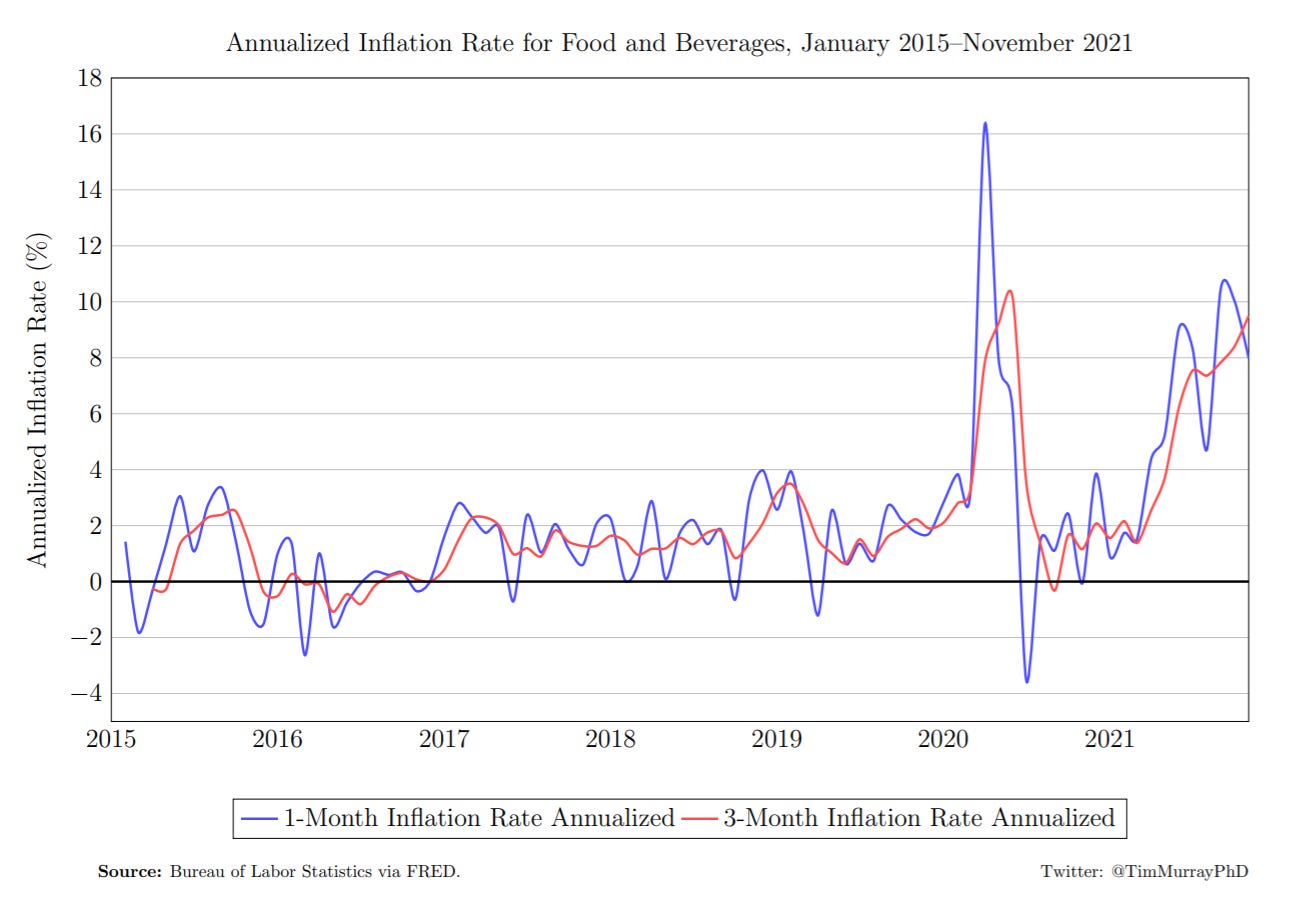

Food and Energy

When economists analyze inflation, we often do so without food and energy. This is because in any given month, there are a variety of reasons these prices could fluctuate that are not reflective of the true price changes of goods and services. If food and energy costs are truly increasing, then this should translate into increased prices of other goods because it will be more expensive to transport and produce them.

Over the last 18 months, we have all seen prices at the grocery store and the price of gas increase. The prices of food are primarily being driven by labor shortages and international supply-chain issues (see one of my previous posts for an explanation of the labor shortage). As the pandemic draws to an end, the supply-chain issues will sort themselves out and many of the labor shortage issues should as well, but as mentioned earlier, it is difficult to determine how long this will take.

The price of gasoline also increased over the last 18 months, largely driven by the same issues contributing to the international supply-chain as previously discussed. However, when adjusting historical prices of gas to account for inflation, the price of gas is not substantially higher than pre-pandemic levels and since mid-November, the price of gasoline has been declining and there is no reason to expect that it won’t stabilize and fluctuate around $2.50 in inflation-adjusted 2019 dollars.

Final Thoughts

Inflation that has been caused by the pandemic is a concern and rising prices have affected everyone. Some people and economists are concerned that we could be entering a period of high inflation, much like the United States saw in the 1970s. However, it is important to note that the causes of inflation in the 1970s were very different from the causes of inflation today. It is likely that current inflation is going to be transitory and not long-term. Eventually, the international supply-chain issues will subside, and the labor-market shortages will recover. We do not know how long this will be as the world is still dealing with the pandemic and every country is dealing with it differently. But eventually, these issues should resolve themselves and the prices of goods driving current increase in inflation should stabilize.